The Ultimate Guide to Using a Secured Credit Card Singapore for Better Financial Management

The Ultimate Guide to Using a Secured Credit Card Singapore for Better Financial Management

Blog Article

Introducing the Opportunity: Can Individuals Released From Insolvency Acquire Credit Scores Cards?

Recognizing the Impact of Personal Bankruptcy

Personal bankruptcy can have a profound influence on one's credit rating rating, making it challenging to gain access to credit or car loans in the future. This economic stain can stick around on credit records for a number of years, influencing the individual's capability to safeguard desirable passion prices or monetary possibilities.

Moreover, personal bankruptcy can limit work chances, as some employers conduct debt checks as component of the employing process. This can present an obstacle to people looking for new job potential customers or profession innovations. In general, the impact of personal bankruptcy prolongs beyond monetary restraints, influencing numerous facets of a person's life.

Variables Impacting Bank Card Authorization

Complying with bankruptcy, people often have a reduced credit history score due to the unfavorable impact of the bankruptcy filing. Debt card companies normally look for a credit rating score that demonstrates the applicant's capability to manage credit score properly. By carefully thinking about these elements and taking actions to reconstruct credit scores post-bankruptcy, individuals can enhance their leads of acquiring a debt card and functioning towards economic healing.

Actions to Rebuild Credit After Bankruptcy

Restoring credit scores after personal bankruptcy calls for a tactical strategy concentrated on economic self-control and regular financial debt monitoring. One reliable technique is to get a protected credit history card, where you deposit a certain amount as security to establish a credit scores limit. In addition, consider becoming an accredited individual on a household member's credit score card or checking out credit-builder finances to additional increase your credit scores score.

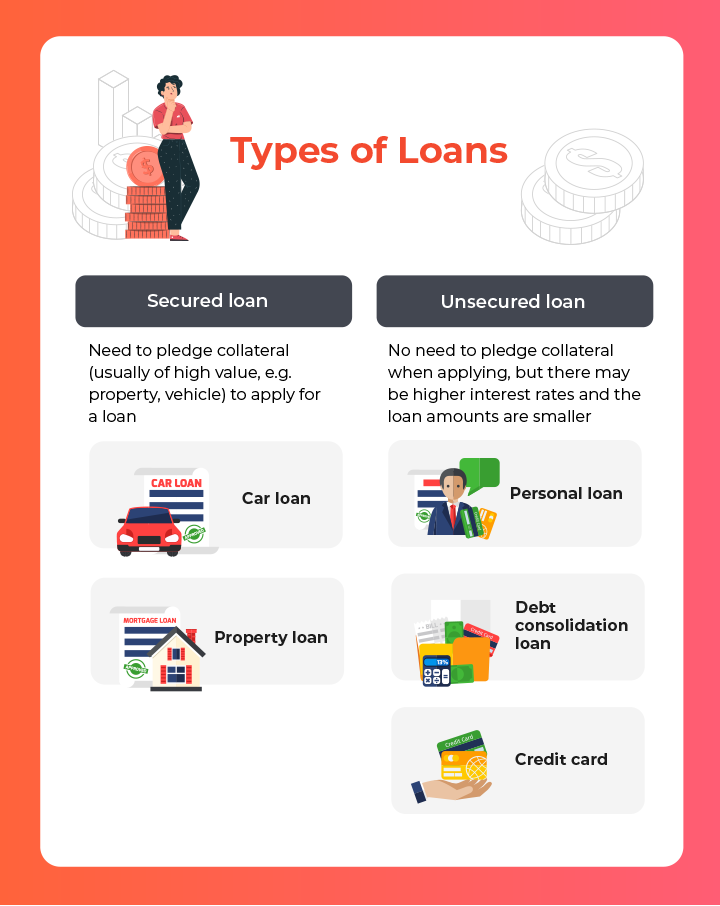

Protected Vs. Unsecured Credit Scores Cards

Adhering to insolvency, individuals typically take into consideration the choice between safeguarded and unsecured charge card as they aim to reconstruct their creditworthiness and monetary security. Protected bank card call for a cash deposit that acts as collateral, usually equivalent to the credit line provided. These cards are less complicated to acquire post-bankruptcy because the deposit lessens the danger for the provider. Nonetheless, they might have higher fees and rates of interest contrasted to unsecured cards. On the various other hand, unprotected credit history cards do not need a deposit yet why not find out more are more challenging to certify for after personal bankruptcy. Issuers examine the candidate's credit reliability and may provide lower charges and rate of interest for those with a good monetary standing. When choosing in between both, people need to weigh the benefits of simpler authorization with guaranteed cards versus the possible prices, and take into consideration unsafe cards for their lasting economic goals, as they can help rebuild credit without binding funds in a down payment. Eventually, the choice in between secured and unsafe charge card must straighten with the individual's financial objectives and capacity to take care of credit responsibly.

Resources for Individuals Looking For Credit Scores Reconstructing

One valuable source for people looking for credit rating rebuilding is credit report counseling agencies. By functioning with a debt website link therapist, people can gain understandings right into their credit score records, find out approaches to enhance their debt ratings, and obtain support on handling their financial resources properly.

An additional handy resource is credit score monitoring solutions. These services enable people to maintain a close eye on their debt records, track any mistakes or changes, and identify possible signs of identification burglary. By monitoring their credit rating frequently, people can proactively resolve any type of issues that might make certain and arise that their debt information depends on date and precise.

Furthermore, online devices and resources such as credit rating simulators, budgeting apps, and financial proficiency websites can provide people with useful info and tools to aid them in their credit history reconstructing journey. secured credit card singapore. By leveraging visit this site right here these sources successfully, individuals released from personal bankruptcy can take meaningful actions in the direction of improving their credit health and securing a better economic future

Conclusion

Finally, individuals released from personal bankruptcy might have the opportunity to acquire bank card by taking steps to rebuild their credit score. Factors such as credit history background, debt-to-income, and income proportion play a significant function in bank card approval. By understanding the impact of personal bankruptcy, picking in between safeguarded and unsafe charge card, and using sources for credit history restoring, people can enhance their credit reliability and potentially acquire access to bank card.

By functioning with a credit therapist, people can get understandings into their credit report records, discover techniques to enhance their credit ratings, and get advice on managing their finances properly. - secured credit card singapore

Report this page